maryland digital advertising tax sourcing

Maryland had estimated the tax on digital advertising could raise about 250 million a year to help increase funding to the states public school system. We cant get rid of it soon enoughThe law would have taxed revenue that the affected companies make on digital advertisements shown in Maryland.

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Lexology

On March 4 2022 a federal judge ruled that the federal Tax Injunction Act TIA bars a challenge to Marylands Digital Advertising Gross Revenues Tax Digital Ad Tax from.

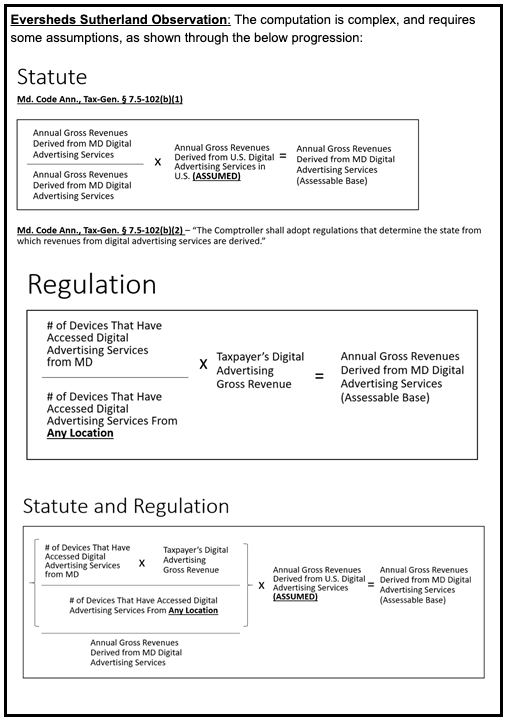

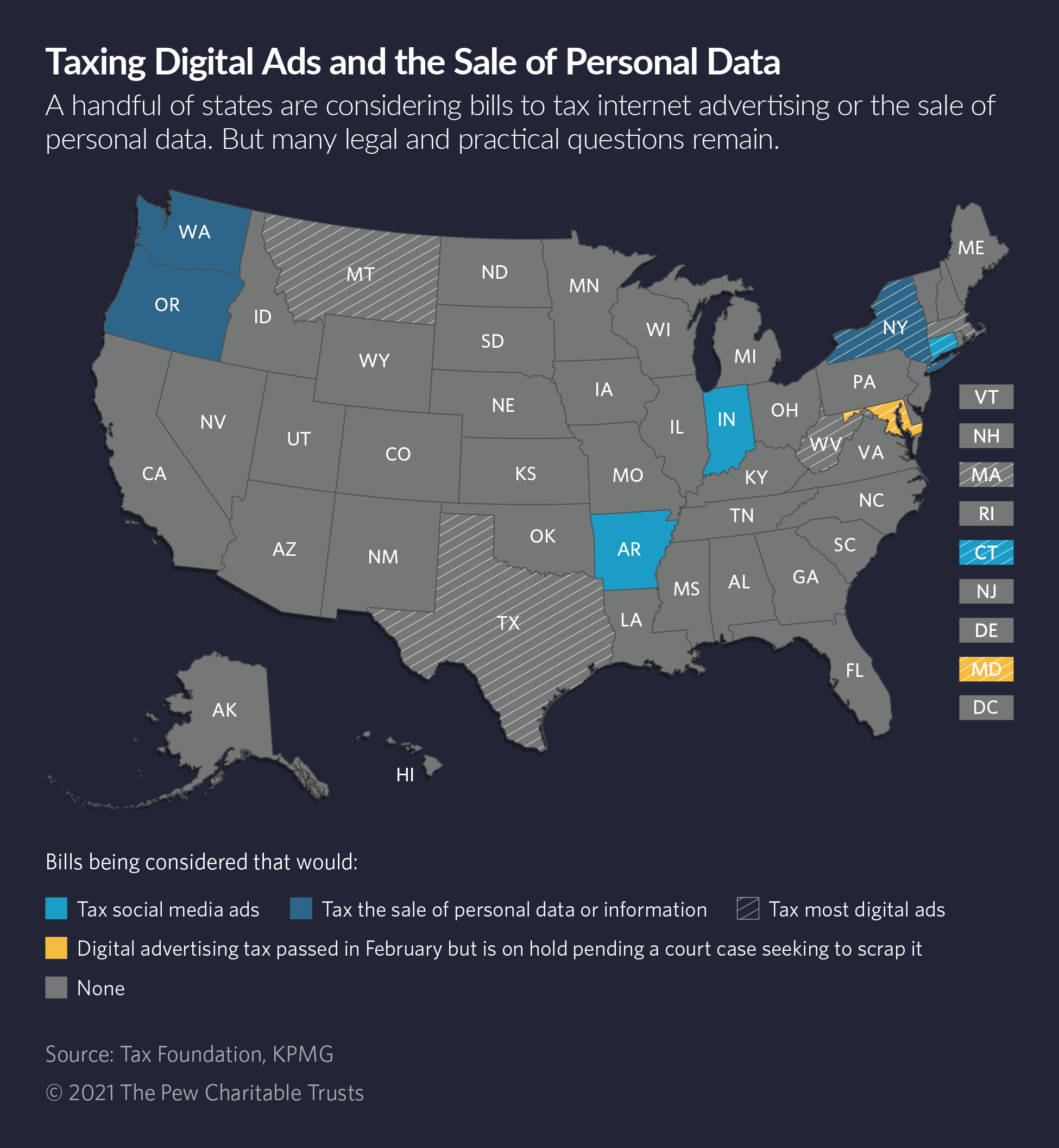

. Digital Advertising Services Tax Sourcing. New Yorks bills A10706 and S08056-A followed the same general structure as Maryland with a 25 - 10 digital advertising gross. The Proposed Regulation would clarify issues delegated by the Legislature to the Maryland Comptroller in the original implementing DAT legislation 2020 HB 732 1 including.

A person must have annual gross revenue derived from digital advertising services in maryland of at least 1 million to be subject to the tax in any year. In a development that should be a surprise to almost no one a state district court judge invalidated Marylands digital advertising tax which was slated to. Marylands digital advertising tax is the first of its kind in the US.

While the Maryland Tax is imposed on digital advertising services in the state the Act does not include sourcing rules or. Late Monday tax law professors Darien Shanske and Young Ran Christine Kim filed a brief in a lawsuit brought by the Chamber of Commerce and Big. Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410-260-7980.

The law aimed to tax the income big technology firms garner from. Maryland is the first state to impose a tax on digital advertising services now the Anne Arundel Circuit Court has declared Marylands digital. October 17 2022 at 715 pm.

5 for companies making 1 billion or more. The tax rate would. First is the lack of clear sourcing rules.

The introduced version of Senate Bill 2 proposed to source and tax digital advertising services to Maryland based on either. On October 17 2022 a Maryland state judge in the Circuit Court of Anne Arundel County struck down the states. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of.

Maryland State Judge Strikes Down Digital Ad Tax. 2 days agoOctober 18 2022 Mari Lou. New York Digital Advertising Gross Revenues Tax.

17 2021 ruling from the bench the judge held that. Maryland enacted a state tax on digital advertising gross revenues on February 12 after overriding the governors veto. October 17 2022.

Its modeled after the digital services taxes weve seen adopted in other countries. Maryland lawmakers overrode Gov. The nations first tax on digital advertising was struck down as unconstitutional by a Maryland judge on.

Digital Advertising Gross Revenues Tax ulletin TTY. 2 days agoA Maryland circuit court judge has struck down Marylands first-in-the-nation digital advertising tax Digital Ad Tax. Larry Hogans veto to pass the digital advertising law last year.

The passed law which is the first of its kind in the. The tax rate would have been 25 for businesses making more than 100 million in global gross annual revenue. Its a gross receipts tax.

Internet Ads Are A Popular Tax Target For Both Parties The Pew Charitable Trusts

New York Takes Another Shot At Taxing Digital Advertising Sales

The Rise Of Digital Ad Taxes Could Impact Online Marketplaces

Videocast 2020 The Year Of Digital Taxation Eversheds Sutherland Us Llp Jdsupra

States Multistate Tax Commission Point To Role Of Digital Economy In State Tax Policy

State Tax On Digital Services And Data Who Pays Taxops

Eversheds Sutherland Tax On Twitter Partner Jeff Friedman Is Profiled In This Law360 Article Featuring The Work That Won Him This Year S Tax Mvp He Secured Multiple Client Wins Challenging Maryland S Novel

Texas Lawmaker Introduces Digital Ad Tax Bill How Does It Stack Up To Maryland S Salt Savvy

Maryland Passes Digital Ad Tax 03 20 2020

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations Mcdermott Will Emery Jdsupra

Maryland Enacts Digital Advertising Gross Revenues Tax

Revived Legislative Bill Adds New York To Growing Number Of States Seeking To Tax Big Tech S Digital Advertising And Sales Of Consumer Personal Data Privacy Portal Blog Insights Events

Maryland S Ad Tax Going Fishing For Revenue Taxops

Maryland Guidance On Digital Products Streaming Tax Kpmg United States

The Fight Over Maryland S Digital Advertising Tax Part 1

Digital Service Taxes Are They Here To Stay Pwc

Maryland Enacts Nation S First Digital Advertising Tax With Strict Penalties For Noncompliance Subject To Immediate Challenges Thought Leadership Baker Botts