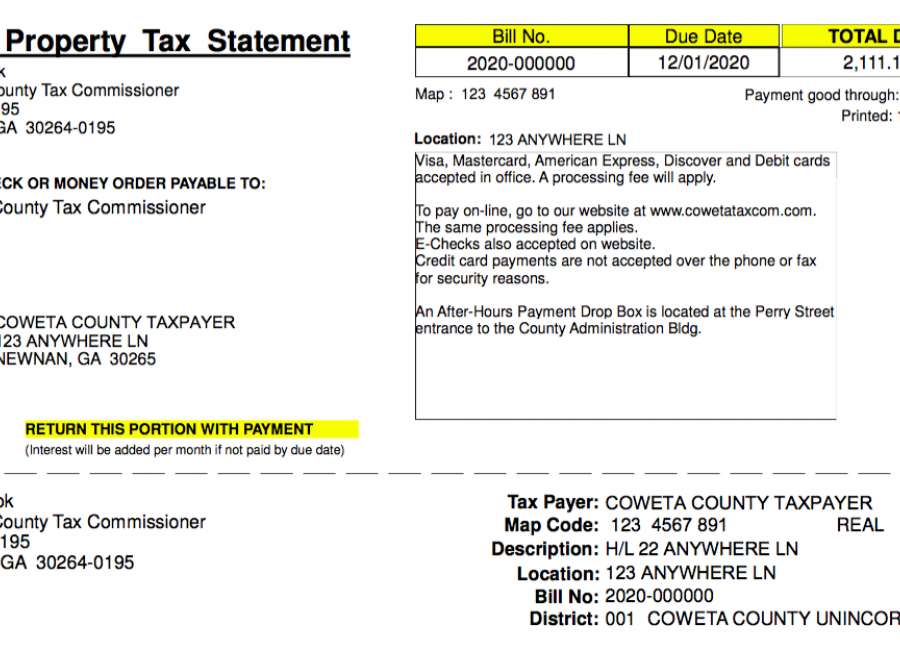

coweta county property tax payments

The Kiosk allows you to renew and receive. Property Tax hours 800am 430pm.

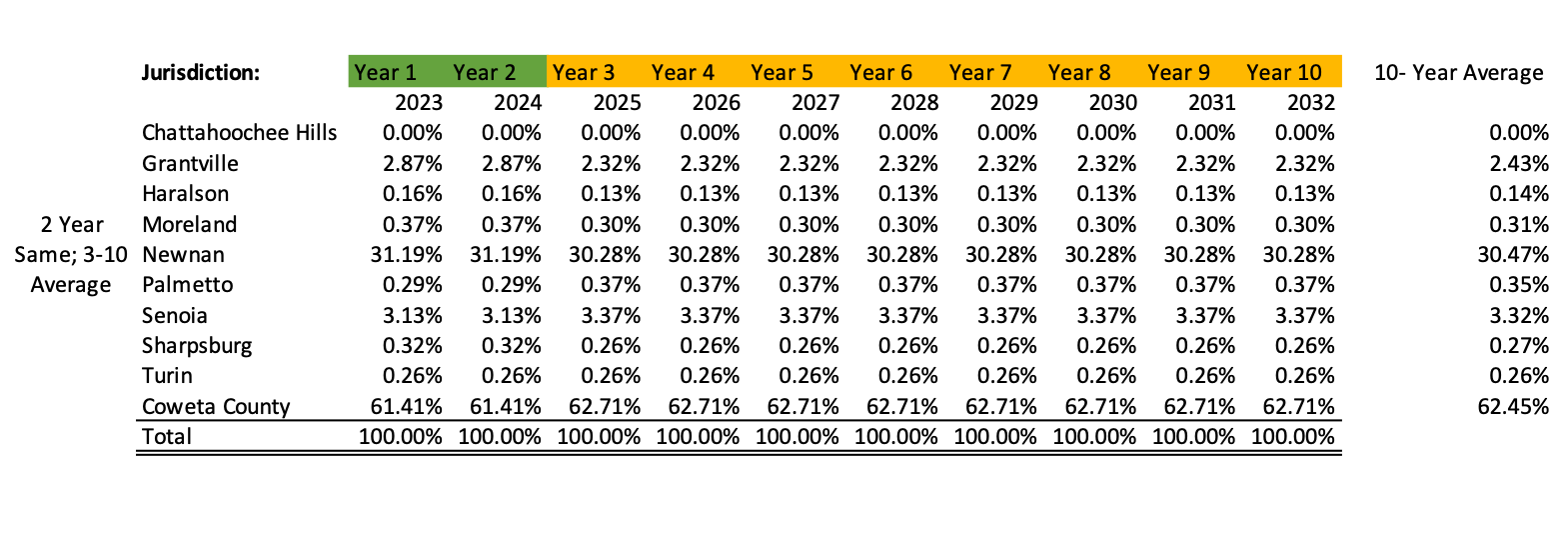

City County Leaders Reach Agreement On Local Option Sales Tax The Newnan Times Herald

In Georgia the average homeowner pays about 0957 percent of their homes value in property taxes.

. If you need to meet with a customer care. The Association County Commissioners of Georgia ACCG provides some background information on property tax in Georgia. - 5 pm Saturday October 22 from 9 am.

Early Vote Monday - Friday from 9 am. Early Vote Monday - Friday from 9 am. Coweta County GA.

Public Notification for TTHM Violation ID 2022-11920 please click HERE for more information. Notice to Property Owners Occupants. Early Voting for the November 8 General Election is underway through November 4.

A NEW tag renewal Kiosk is available in the Newnan Crossing Kroger at 1751 Newnan Crossing Blvd. Early Voting for the November 8 General Election is underway through November 4. Early Voting for the November 8 General Election is underway through November 4.

Property Tax hours 800am 430pm. In accordance with Georgia Law OCGA 48-5-2641 property owners and occupants are notified that appraisers from the Tax Assessors office. Planning Development Ordinances.

The Kiosk allows you to renew and receive. A NEW tag renewal Kiosk is available in the Newnan Crossing Kroger at 1751 Newnan Crossing Blvd. A NEW tag renewal Kiosk is available in the Newnan Crossing Kroger at 1751 Newnan Crossing Blvd.

Early Vote Monday - Friday from 9 am. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. Together with Coweta County they count on real property tax receipts to perform their public.

Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Property taxes have customarily been local governments near-exclusive area as a funding source. The property tax rate in Coweta County GA is 075.

Government Tax Information. The Kiosk allows you to renew and receive. Make A Payment Forms and Helpful Info Contact Us - D27 Adair County Cherokee County Sequoyah County Wagoner County Divisions Emergency Services E911 Emergency.

For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at. Pay Property Tax Online in the County of Coweta Georgia using this service. Taxing authorities include Coweta county governments and.

There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments. - 5 pm Saturday October 22 from 9 am. The tax for recording the.

- 5 pm Saturday October 22 from 9 am. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. Lobby is closed due to remodeling.

Property Tax hours 800am 430pm. Coweta County collects on average 081 of a propertys assessed. What is the property tax rate in Georgia County Coweta.

770 254-2601 Coweta County Board of.

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Petition They Cooked The Books In Order To Increase Property Taxes Change Org

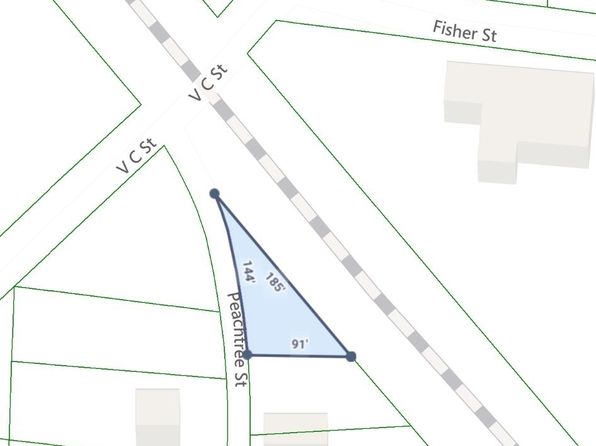

Geographic Information Systems Gis Coweta County Ga Website

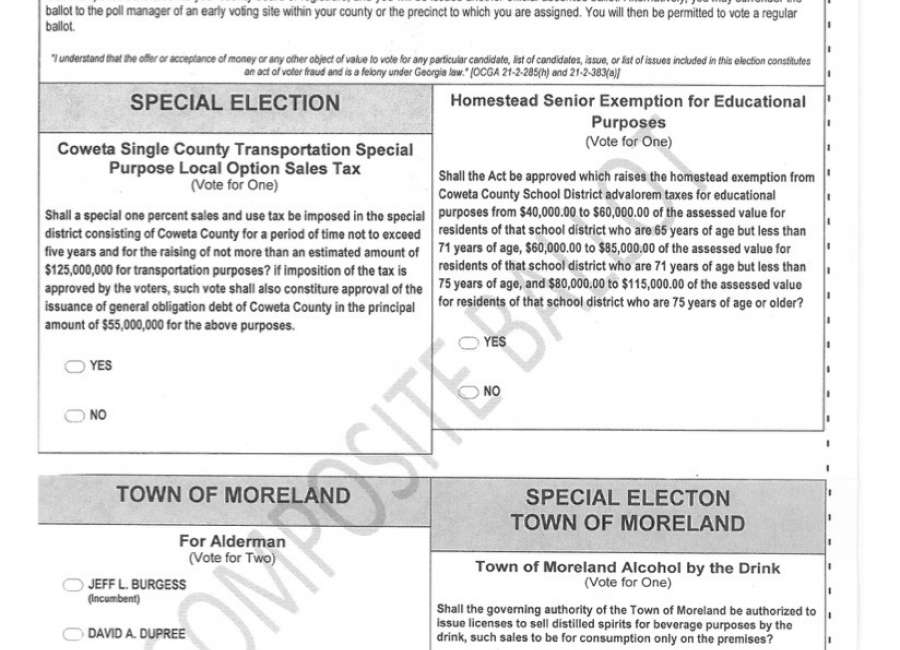

Early Voting Saturday County City Races On Ballot The Newnan Times Herald

Coweta County Government Facebook

Coweta County Government Facebook

2 22 2022 Coweta County Board Of Commissioners Meeting 2 22 2022 Coweta County Board Of Commissioners Meeting By Coweta County Government Facebook

Lgs Local Property Tax Facts For The County Georgia Department

Coweta County Sheriff S Office Coweta County Ga Website

Coweta County Ga For Sale By Owner Fsbo 11 Homes Zillow

School Board Sets Property Tax Rate At 16 Mills The Newnan Times Herald

Cowetaliving2016 Lowres By The Times Herald Issuu

How Healthy Is Coweta County Georgia Us News Healthiest Communities

Houses For Rent In Coweta County Ga 157 Homes Zillow